Grow your money effortlessly with Plum

Do you struggle to save for specific goals? Or perhaps you save money in a designated account and then all too easily end up using it for something else entirely?

I have definitely been guilty of all of the above, and if you’re anything like me, then the money management app Plum will be a lifesaver!

What is Plum?

Plum is an automated money management app, accessed via an Android or iOS app that is linked to your bank account(s) of choice. (All major UK banks are supported, including Starling and Monzo.)

Using an algorithm, it is able to calculate how much you are able to set aside based on your monthly outgoings and spending habits. The amount and frequency it is able to stash money for you will vary from person to person depending on income and outgoings.

I was delighted when Plum approached me to work with them on this post, because if you have followed me for a while you will know that I have been an avid user for well over 2 years.

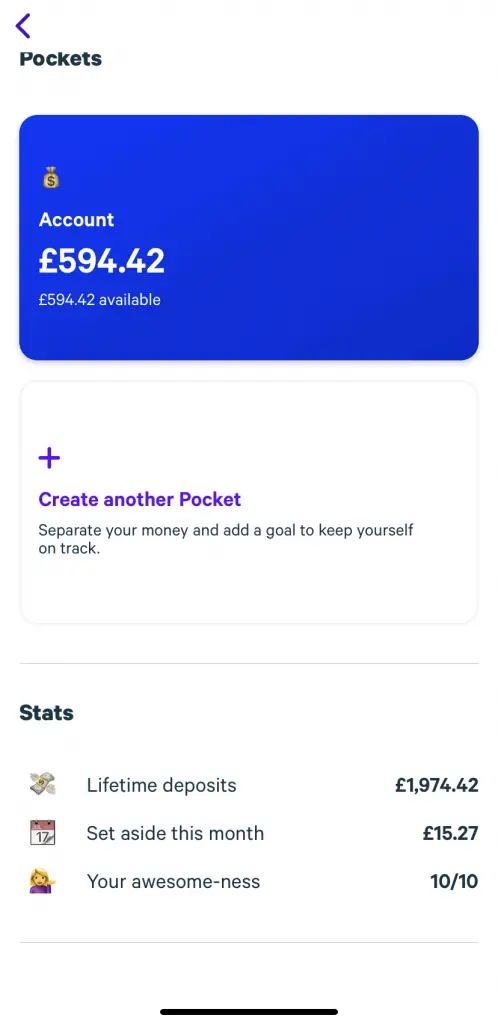

Since I joined Plum in April 2017, it has set aside a grand total of £1974.52 (Update November 22: This is now £3238.02). That’s a lot of spare change!

Not bad considering I never notice the money being taken, and, unlike another money management app I once tried out, not once has it ever taken money that would take me into a negative balance or leave me short for a direct debit. (More on that below).

The app is a relatively new addition to Plum, as prior to this everything was done via Facebook Messenger. However, it has added a wealth of handy features.

Any bank accounts linked to Plum get a breakdown within the app of current balance, upcoming regular payments and latest transactions. It’s actually a lot more detailed and straightforward than my bank’s own app!

I can see at a glance what my current account balance is, as well as receive daily balance notifications which is something my bank don’t offer.

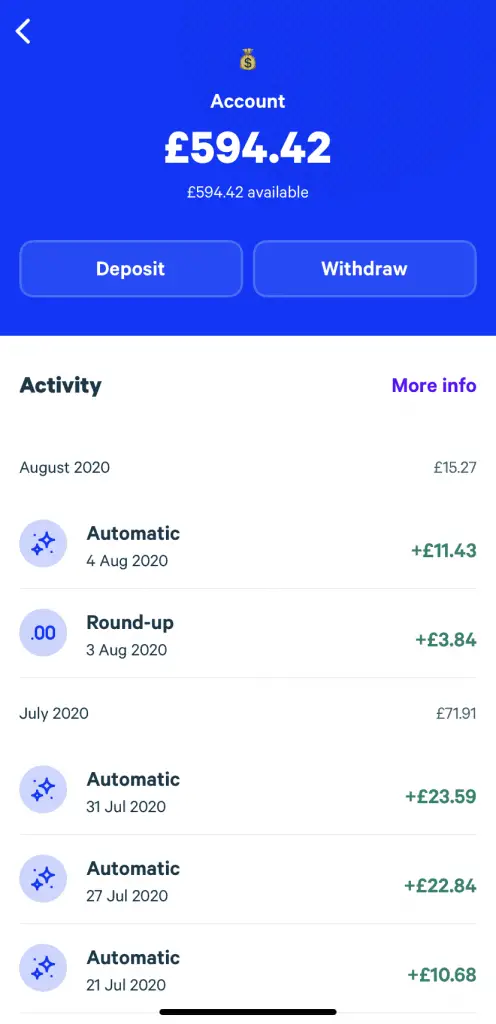

Within my Plum ‘pockets’ section is a breakdown of every transaction that has been taken, as well as a summary of my lifetime funds. I think it is really motivating to see at a glance how these small amounts really add up. You will notice from the screen shot that some payments are taken as “Round Ups”.

This opt-in feature will simply round up the previous week’s transactions to the nearest £1 and transfer the spare change over every Monday.

For example, if I spend £3.50 on a sandwich from my linked account then Plum will round it up to £4.00 and save 50p for me. Again, I never miss this money leaving my account and little amounts really add up!

Also included within the app are cashback offers for a range of high street brands including Argos, eBay, Groupon and Dominos, as well as a “Lost Money” section designed to find you the best deals on energy suppliers, loans and insurance similar to a price comparison site. To have all of this within one app is a great addition and I will be sure to check both of these extras out the next time I make a relevant purchase.

Using Plum

If you read some of my earlier posts, you will know that money saving became a real issue for me when I changed from a full-time income to a part time working mum. I wasn’t a good saver as I had never needed to save before, and as a result I was ill prepared for expensive events such as Christmas and holidays.

When I first set up Plum in April 2017 I didn’t have a goal for the money in mind, but by the end of November, both myself and my husband had over £300 each in our Plum accounts, which was enough to take advantage of a Black Friday deal on an American Fridge Freezer. It was an amazing feeling knowing we had bought something we really wanted without even noticing the money being stashed away!

After that I decided I would use the money set aside between January and the end of November to cover my Christmas spending with the aim of having £500 minimum. It has been a literal life changer to have this money moving into my Plum account all year without noticing it!

Thanks to lockdown and a reduction in my own spending, I currently have almost £600 set aside for Christmas 2020 which has exceeded my November goal 4 months early! I am happy to let this money continue to build up, but when I do want to withdraw, the process is simple and the money will transfer to my linked account within 30 minutes.

This all sounds great, but I’m a bit unsure about linking my bank account to an app…

It is obviously right to be cautious when it comes to money, and the biggest reservations I have seen involve the security of linking bank accounts, and letting an app withdraw amounts that could potentially lead to going overdrawn.

Obviously, I don’t work for Plum and cannot address these issues in a professional capacity, so the best place to get all the information you need is the official Plum website.

However, on a personal level I cannot recommend it enough. The Plum algorithm is really something because in over 2 years it has never once taken money that was needed for a bill or that would take me into the red. However, if this was the case, they have got you covered.

It is a real eye opener to see that I have set aside over £3000 in 5 years from small change. It’s a sobering thought to wonder where that money would have been spent otherwise, as I’m pretty sure I wouldn’t have much to show for it!

If you would like to join myself and over 1 million other Plum customers, you can sign up here.

Other Posts You May Like

What is a sinking fund and why you need one

Organise your money with Smart Bank Accounts